Evergrande Debt Crisis

The danger is precisely the. China Evergrande Group saddled with more than 300 billion in total liabilities equivalent to 2 of Chinas GDP is in the throes of a liquidity crisis that has it scrambling to raise funds to.

Mpjmyogtbf7bam

Contagion could spread to markets beyond China.

Evergrande debt crisis. Evergrande achieves one of the debt ratio caps set by regulators by cutting its interest-bearing indebtedness to around 570 billion yuan from 7165 billion yuan six months ago. Evergrande crisis and the US. Debt-ceiling showdown could give stock investors a buying opportunity Last Updated.

The issue isnt entirely new. China Evergrande is struggling with more than 300 billion in debt. China property giant Evergrande admits debt crisis as protesters besiege HQ Disgruntled investors voice anger at headquarters as company appoints advisers and says firesale of assets wont cover.

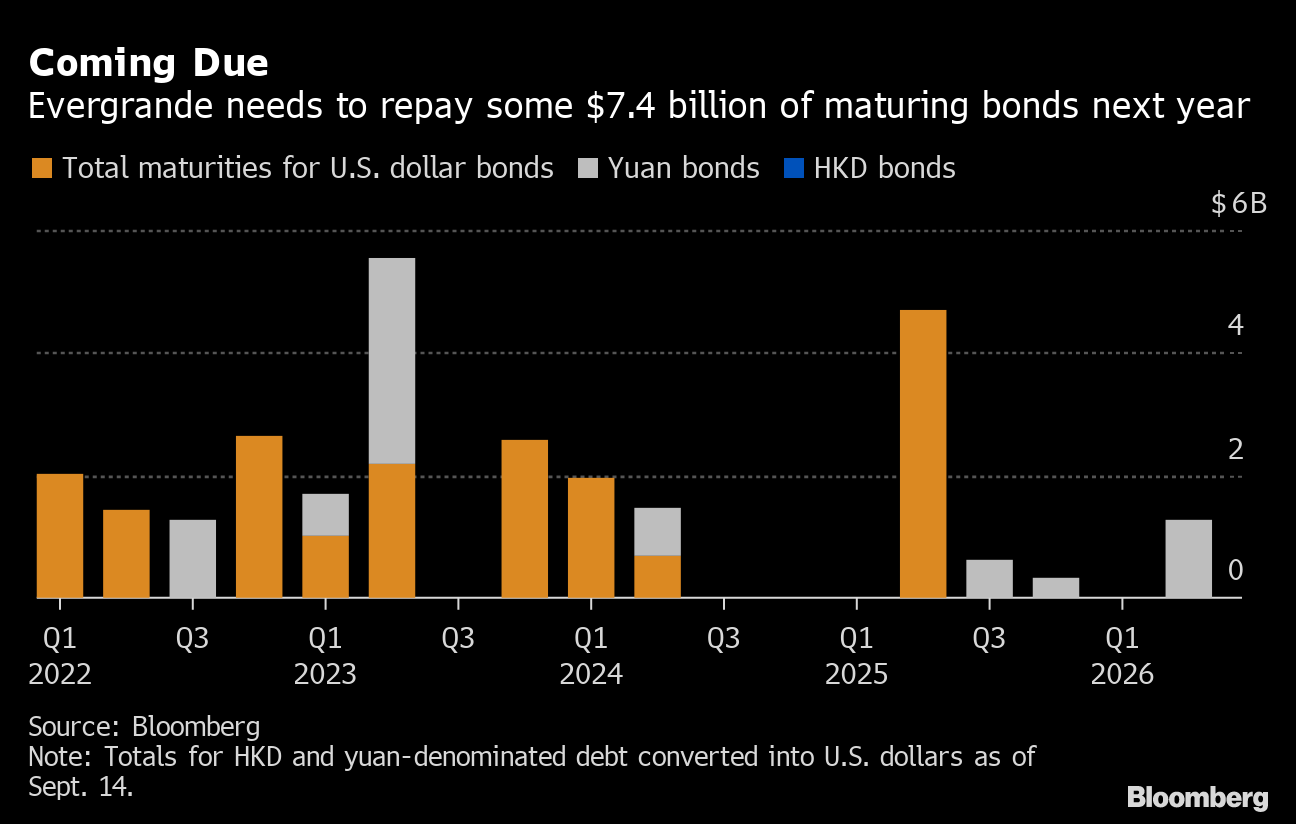

And interest payments totaling more than 100 million are due later this week on two of the companys bonds according to data provider Refinitiv. As Chinas Evergrande verges on collapse its. Evergrandes debt crisis is continuing to unsettle investors in Asia and raising concerns about whether a potential default by the troubled Chinese conglomerate could spill over to other parts of.

20 2021 at 750 pm. Last year a slew of Chinese state-owned companies defaulted on their loans raising fears about Chinas reliance on debt-fueled investments to support growth. 5 things to know about the Chinese business empire on the brink Evergrande did not immediately respond to a request from CNN Business for comment about those payments.

T he crisis engulfing Evergrande Chinas second-biggest property company is the greatest test yet of President Xi Jinpings effort to reform the debt-ridden behemoths of the Chinese economy. At its Shenzhen headquarters angry suppliers and investors demand overdue pay. Evergrande debt crisis.

Evergrande is faced with more than 300 billion in debt hundreds of unfinished residential buildings and angry suppliers who have shut down construction sites. Snowed under its crushing debt of 300 billion Evergrande is so huge that the fallout from any failure could hurt not just Chinas economy. The troubles of Chinese conglomerate Evergrande have dominated headlines in recent days after it warned once again that it could default on its astronomical debt because of a cash crunch.

The 305 billion debt crisis facing Chinese property developer is a manageable situation said Ray Dalio. Evergrande says the loan is not due until next March and it plans to take legal action. Chinese property giant Evergrande warns it could default on debt The companys debt crisis which has already brought angry investors to its doorstep in protest could ripple through Chinas.

July 2021 A court orders a freeze on a 132 million yuan bank deposit held by Evergrande at the request of China Guangfa Bank Co. Evergrande achieves one of the debt ratio caps set by regulators by cutting its interest-bearing indebtedness to around 570 billion yuan from 7165 billion yuan six months ago. The story of Evergrande is the story of the deep and structural challenges to Chinas economy related to debt said Bekink.

In Tuesdays interview he said Evergrandes crisis isnt same as the 2008 collapse of. Evergrande the worlds most indebted property developer is crumbling under the weight of more than 300 billion of debt and warned more than once it could default. The biggest fear investors should have with the crisis gripping overly indebted Chinese real estate developer Evergrande is global contagion argues Goldman Sachs.

Outside the Box Opinion.

Lgfa7z5kpvhndm

Mjx Qgvbhs3ugm

Bxk1 Nmc9whf M

Qedoeqnguvqfgm

Srqjxawjdcfjlm

China S Debt Surge May Increase Risk Of Financial Crisis Debt Crisis Financial

Fqugpik0y7r7rm

3x4iv5zccxgbmm

Evergrande Debt Crisis A Risk To China S Banks Bonds And Jobs Market Asia Financial News

Hnpviyhq Cu9ym

Evergrande China S Fragile Housing Giant Rfi

What Is China Evergrande And Why Is It In Trouble Bloomberg

D73qnvnzrwywvm

Qvysczyssmw Zm

How China Evergrande Landed In Crisis Mode Again A Timeline In 2021 Debt Problem Equity Ratio Financial Stability

Dhw3ychxjlix2m

I7sl2g0md659wm

P9req2habhrmrm

Ljgxkzareh8apm